What are CTC models, and what do you need to know about them?

What is a CTC model?

What does CTC stand for?

Continuous Transaction Control (CTC) models refer to the mandatory transaction data reporting and verification procedure to be followed in order to submit e-invoice data to the relevant tax authority. This allows the relevant tax authority to collect data on-line and allows for comprehensive records to be kept for compliance supervision.

The countries who have implemented a CTC model to regulate transactions, do so with the intent to reduce tax fraud and improve VAT collection. The use of such a model will allow for the better management of tax avoidance and recordkeeping.

The adoption of a CTC model will assist in the auditing process, as the current standard is that an audit happens long after the transactions occurrence (post-audit model)

What are the existing CTC models?

Centralised Models

The process to be followed is where all e-invoice data is cleared by the relevant tax authority via a tax agency platform, prior to the e-invoice being sent to the end recipient.

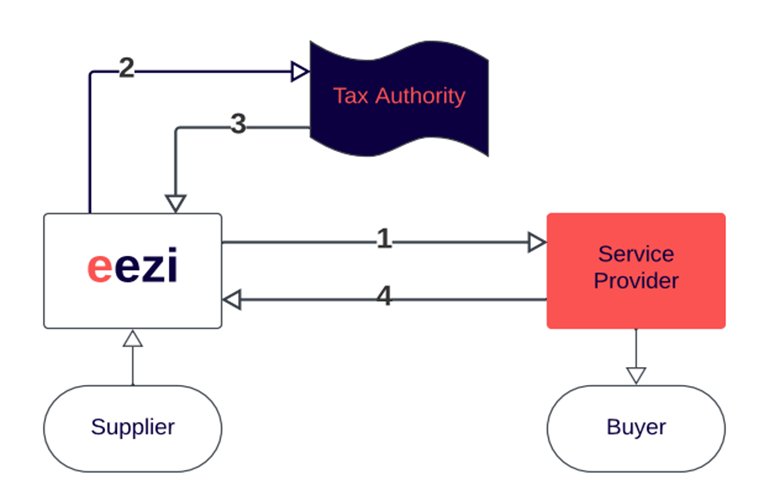

Decentralised Models

The supplier is able to issue and send e-invoices to the end recipient directly, however, in parallel sending the e-invoice data to the relevant tax authority for reporting purposes.

CTC Models – Breakdown

It is clear from the above that CTC models will be utilised to ease the digitalisation of invoicing and reporting processing. It is also noteworthy that every country will have varying forms of a CTC model, due to their own internal processes and design.

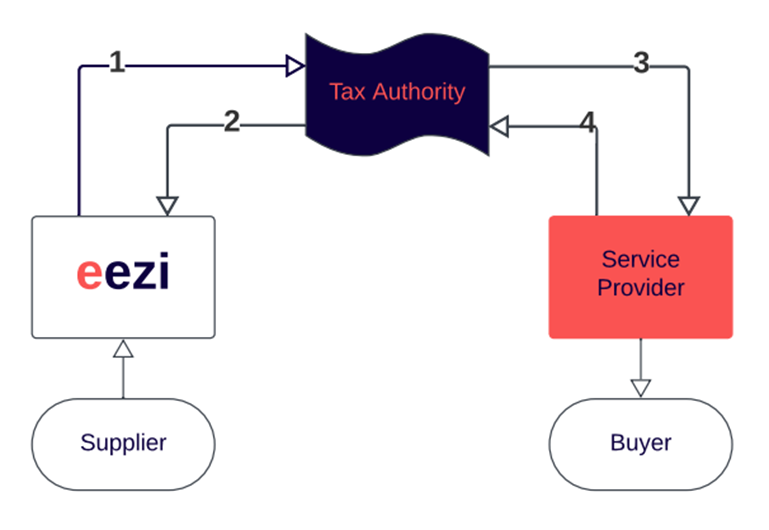

Clearance Model

The Clearance model provides for the ‘clearance’/ validation of invoice data prior to the issued invoice being sent to the recipient/consumer/buyer. This can be done by way of a central platform, such as Servicio de Administración Tributaria (SAT), which is the e-invoicing central platform utilised in Mexico. The relevant economic operatory will provide for a specific invoice format that is to be used by taxpayers on the central platform.

Process: A supplier, after issuing an invoice will submit the e-invoice, in the correct legal format, to the designated platform (the use of a service provider can ease the submission process, as the supplier will not have to greatly adapt their transaction process). The relevant tax authority will clear/validate the e-invoice data and provide the supplier, via the platform, with the validated e-invoice data. After which, the supplier can proceed to send the validated e-invoice to the end recipient.

Therefore, invoice data is exchanged directly between the taxpayers and the relevant tax office, with or without the use of a service provider, such as eezi.

Centralised Exchange Model

The Centralised Exchange Model can be an added feature to the Clearance Model, i.e. a model that supports public procurement. The centralised exchange model replaces the direct exchange of transaction data between suppliers and recipients themselves, in relation to specific circumstances. This method of exchange can be used for both B2G and B2B transactions.

Features: A central network is established by the relevant Tax Authority (Controlling body) to allow for the exchange of e-invoices between suppliers and recipients. This model provides for connectivity to an available interoperability network to support domestic and non-domestic transaction exchanges.

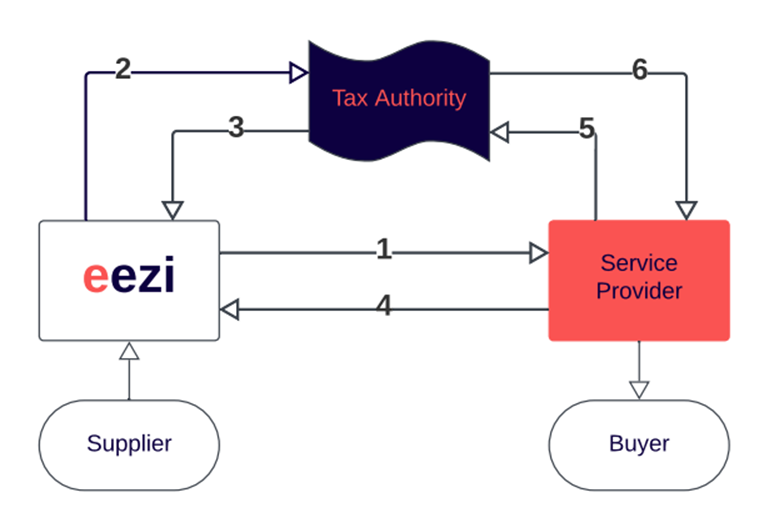

Decentralised CTC and Exchange Model (DCTCE)

A proposed effort by important e-invoicing participants, globally, who wish to establish fully interoperable systems and business automation have proposed a decentralised model for means to exchange transaction data.

The proposed features: Validation and the exchange of transaction data is performed by certified e-invoicing and e-reporting service providers, and NOT by a central platform. However, the service provider will need to be certified by the relevant Tax Authority.

Benefit: This model allows for business entities to utilise existing investments in interoperability technology adaptation and Electronic Data Interchange (EDI), as well as the investments made by Government institution in respect of the creation of central platforms. Therefore, a centralised and decentralised CTC model will be able to coincide.

European countries that have adopted the model, in recent years, is Italy, France and Spain.

Real-Time Invoicing Reporting (RTIR) Model

This model requires taxpayers to report their e-invoicing data to the relevant Tax Authority or governing body shortly (‘in near real-time’), after the issuance and exchange of an e-invoice.

Features: A central platform is established by the relevant governing authority, which may require the use of certified invoicing software. Taxpayers are to submit the invoice data to the relevant platform within 24-72 hours of issuance of the invoice. The interval frequency will vary from country-to-country dependant on their own design and process.

Conclusion

In summary, the above CTC models assist in the digitalisation of the invoicing and reporting systems. There is a Centralised Model, Decentralised Model, Real-Time Reporting Model and the Clearance Model, of which the Clearance model can work concurrently with the centralised and decentralised models. At the adoption of ViDA, the e-invoicing world will be hearing more of the usage of these models and the adaptation thereof on a country-by-country basis.