Peppol in France: French e-invoicing mandate and PDPs

Background: E-invoicing in France

On 15 October 2024, the Ministère Chargé du Budget et des Comptes Publics, with the direction Générale des finances publiques (‘DGFiP’) of the French tax authority, did a press release in which the DGFiP stated that there will be a reform in the development of the e-invoicing system in France.

Where the initial approach had been to provide users with the option of deciding between either PDPs (Partner Dematerialisation Platforms) or the FREE alternative of a PPF (Portail Public de Facturation), the option of a PPF has since been discarded. The external specification and internal technical specifications in the invoicing process will have to adapt to this transition. Business entities must, therefore, exclusively nominate or make use of PDPs.

The purpose of the 'reform' is to ensure the 1 September 2026 e-invoicing and e-reporting mandate launch.

The Peppol Network

The reform was a cause for concern, as the popular query raised was whether the system's interoperability will function in the absence of a direct link to the French Government, that being the French Tax Authority.

In response, the DGFiP confirmed in December 2024, in an FNFE presentation, that it has initiated the application process to become a Peppol Authority for France. DGFiP will, once appointed as the French Peppol Authority, hold the responsibility of promoting the Peppol Standards and the duty to regulate the interoperability between PDPs and their e-invoicing compliance. The appointment of a Peppol Authority in France is a progressive step, as the country prepares for its electronic invoicing mandate to close the country's VAT gap.

In the meantime, though, OpenPeppol has stated that it will take on the role as the interim Peppol Authority for France, until the DGFiP's pending application is approved, in either 2025 or at the start of 2026. OpenPeppol has already confirmed the completion of a demonstrative-model for the exchange of e-invoices in France via Peppol. Guidance will be furnished by OpenPeppol to all the interested stakeholders in the French e-invoicing landscape.

The use of the Peppol (Pan-European Public Procurement) platform will ensure the standardization of the method of electronic transactions, making public procurement more interoperable in the EU. There is approximately 17 current Peppol Authorities.

Where would Peppol fit-in?

Peppol is a secure system, originating in the EU, that provides the private and public sector with the ability of exchanging electronic documents in structured formats.

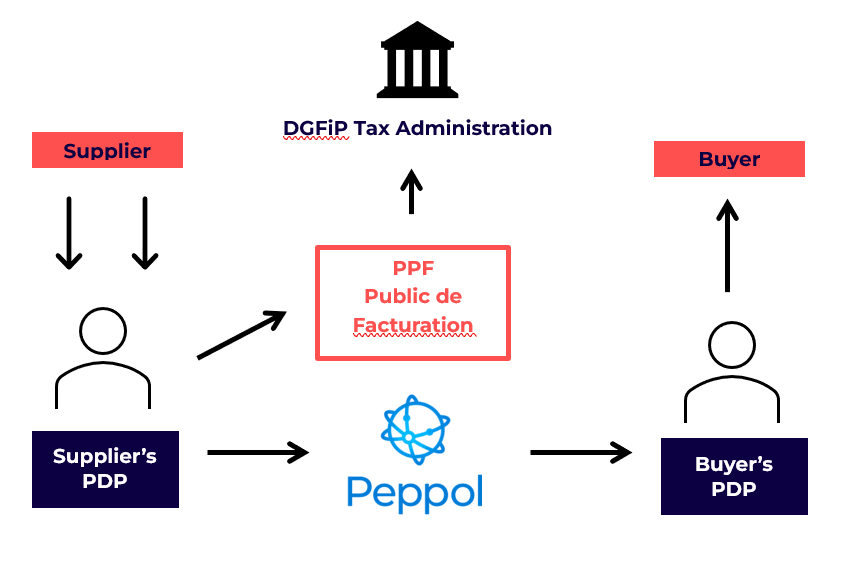

France will be implementing a five-corner continuous transaction control (‘CTC’) model, or the “Peppol”-model, as illustrated in the diagram below.

As the above diagram would indicate, France will be relying solely on PDP-accredited service providers for the exchange of electronic transactional data. This also means that business entities will not be able to connect directly to the PPF Data Hub for purposes of invoice exchanges. Business entities will have to employ an accredited PDP, who also needs to be accredited as a Peppol Access Point, to send and receive e-invoice data via the Peppol Network.

La Fin

In closing, the French government has transitioned from the initial e-invoicing and e-reporting development plan to a Peppol-based solution, making use of the Peppol Network. This is done to ensure the current e-invoicing implementation timeline, being: From September 2026, all businesses (B2B or B2C) must be able to receive e-invoices; and the B2B e-invoicing mandate will apply to large and medium-sized companies.

Note: B2G e-invoicing has been required by France since 2017.

Do you need an e-invoicing solution in France? eezi – Powered by VATit can help with that!