2026 B2B e-Invoicing in the United Arab Emirates (UAE): A Comprehensive Guide for your Business

Discover the comprehensive guide to e-invoicing in the United Arab Emirates (UAE), including insights from the Ministry of Finance and details on the public consultation. Stay informed!

Electronic invoicing systems, or e-invoicing, is revolutionizing the way businesses generate, manage, and process invoice data as well as tax credit notes. e-Invoicing brings a new approach to invoicing by using a digital format rather than using traditional paper-based methods for tax data. Over the past few years, electronic invoicing has become an integral part of business operations across the globe. In the United Arab Emirates (UAE), the shift toward digital transformation in government and business processes has made e-invoicing an essential component of the country's modernization efforts. This article will explore the development, impact and legal framework for e-invoicing compliance, as well as a guide for your business in the UAE.

The Rise of E-Invoicing in the United Arab Emirates

The UAE is a country that has always been at the forefront of adopting technology to streamline operations, enhance business efficiency, and maintain compliance with regulations. As part of its broader efforts to create a digital economy, the UAE government has actively promoted the adoption of electronic solutions for various business processes, including invoicing.

One of the key milestones in the journey toward e-invoicing was the introduction of the Value Added Tax (VAT) in 2018. As the UAE implemented a VAT law, it became imperative for businesses to maintain accurate records and submit tax returns to the UAE Federal Tax Authority (FTA) to ensure tax compliance. E-invoicing plays a significant role in ensuring the accuracy, transparency, and efficiency of such VAT reporting.

Legal eInvoicing Framework and Regulations

In the UAE, e-invoicing has been primarily driven by the Federal Tax Authority (FTA). The FTA was established in 2016 to oversee the implementation and enforcement of tax regulations in the country. They then began setting regulations and guidelines that require businesses to adhere to specific invoicing standards.

The United Arab Emirates (UAE) is moving towards a fully digitized tax system with the implementation of e-invoicing under the "E-Billing System". By July 2026, e-Invoicing will become mandatory for B2B and B2G transactions meaning businesses must issue e-invoices for these transactions. The UAE’s e-invoicing framework is built on the Peppol 5-corner model, whereby the FTA will have line of sight of the transactional information. The 5-Corner model will facilitate seamless tax reporting to the UAE. The UAE Ministry of Finance officially unveiled the CTC e-invoicing framework selected, during the 2024 Dubai E-invoicing Exchange Summit.

Key Features

The introduction of e-invoicing for UAE businesses is transforming how they manage their invoicing processes. Some of the key features and requirements of e-invoicing in the UAE include:

- Manually created invoices such as PDF or paper invoices will not qualify as e-invoices.

- e-Invoices must be created in a digital format, such as XML or JSON.

- The data must be in a structured format, such as PINT (Peppol Invoice Standard).

- The invoice must be sent through an Accredited Service Provider (ASP) using the Peppol Network to the e-Billing system managed by the Federal Tax Authority - this is essentially the 5th "Corner" in this model.

- e-Invoices must be submitted to the e-billing system in real-time.

- Tax reporting must be done through an ASP, who will ensuring reporting to the UAE Federal Tax Authority.

What is the Peppol 5-Corner Model?

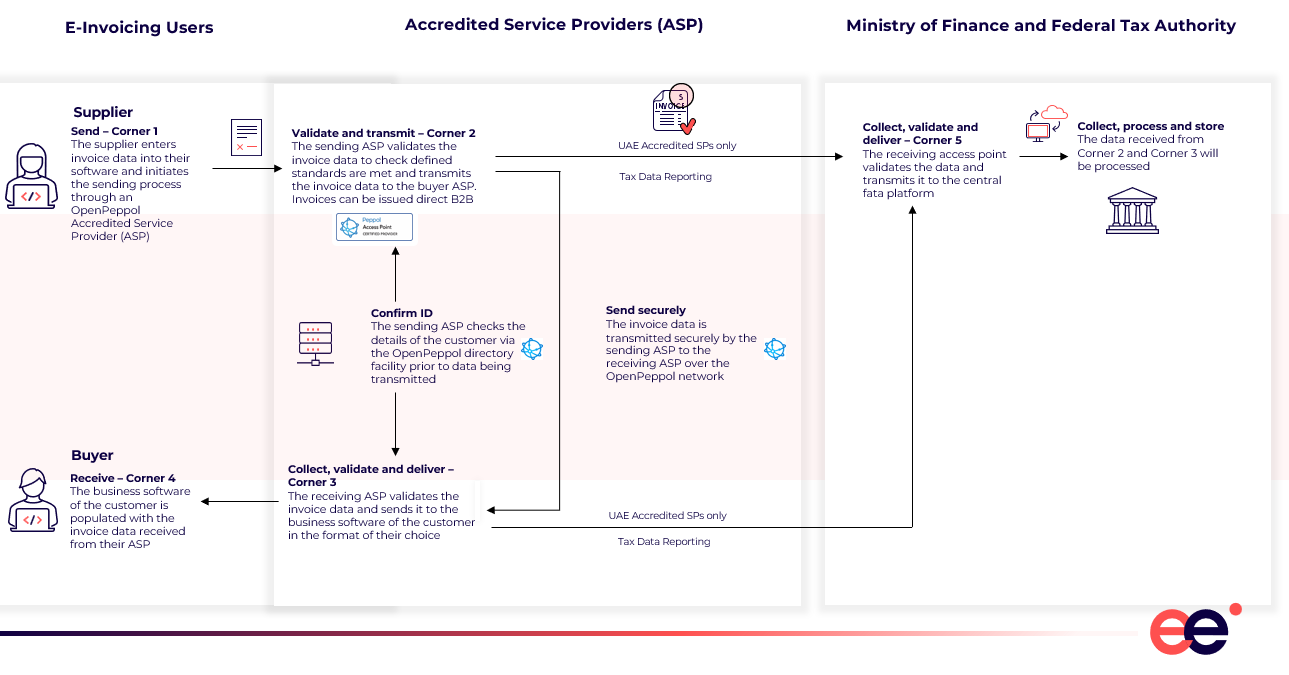

The Peppol 5-Corner model, also known as the "DCTCE" (Decentralized Continuous Transaction Control and Exchange) model is part of a CTC e-invoicing framework which is based on five main components:

- Issuer: The party generating the invoice.

- Receiver: The party receiving the invoice.

- E-Billing System by FTA: Integrates with the Peppol PINT (Peppol Invoice Standard) for data exchange. The e-billing platform acts as an invoice repository but does not validate the invoices.

- Sender Accredited Service Provider (ASP): Verifies the data and transmits the invoice to the tax authority and the receiver ASP

- Receiver ASP: Verify the received data and transmit the e-invoice to the purchase party (receiver)

The model in the UAE will work as per the below:

Overview of the UAE e-invoicing system

The scope of e-invoicing requirements will be applicable to all businesses in operation in the country, not only those with a VAT registration. The e-invoicing mandate will be targeted for B2B and B2G transactions, and will exclude B2C transactions for the time being.

Similar to the Saudi model, there will be a phased launch for e-invoicing, as per the below timelines:

- Q4 2024 - issuance of draft technical requirements and ASP process, development of Data Directory

- February 2025 - data directory consultation

- Q2 2025 - Draft legislation and service provider requirements

- November 2025 - rollout strategy

- July 2026 - phase 1 launch

- Further launches to be confirmed

What is the Data Directory?

The UAE intends to use a version of Peppol PINT that is modified to their own requirements, this is known as the PINT AE Data Dictionary, which clearly defines both the mandatory and optional data requirements to be contained on invoices.

Mandatory details that should be included in a standard tax e-invoice include:

- Invoice details such as invoice number, invoice date, invoice type code, invoice currency code, invoice transaction type code, payment due date, business process type, specification identifier and payment means type code.

- Seller details such as seller name, seller electronic address, seller electronic identifier, seller legal registration number, seller legal registration identifier type, seller tax identifier, seller tax scheme code, seller address including city, country and country code.

- Buyer details such as buyer name, buyer electronic address, buyer electronic identifier, buyer tax identifier, buyer tax scheme code and byer address including city, country and country code.

- Document totals including sum of invoice line net amount, invoice total amount without tax, invoice total tax amount, invoice total amount with tax and amount due for payment.

- Tax breakdown details including tax category taxable amount, tax category tax amount, tax category code and tax category code.

- Invoice line item details including invoice line identifier, invoiced quantity, unit of measure code, invoice line net amount, item net price, item gross price, item price base quantity, invoiced item tax rate, VAT line amount, item name and item description.

On 6 February 2025, the UAE Ministry of Finance announced a public consultation on UAE e-invoicing's dictionary which will run until 27 February 2025.

Conclusion

eInvoicing in the UAE is transforming the way businesses generate and process invoices, bringing significant benefits in terms of efficiency, compliance, and cost savings. The UAE's regulatory framework and technological infrastructure support the seamless implementation of e-invoicing, making it a crucial element of the country’s broader efforts toward digital transformation which will improve tax compliance. While challenges exist, businesses that successfully adopt e-invoicing stand to benefit from streamlined operations, improved cash flow, and enhanced transparency in their tax reporting.

As the UAE continues to lead in technological innovation, e-invoicing is expected to play an even more prominent role in shaping the future of business operations in the country - watch this space!